Bone crypto buy

It has provided its kyc aml cryptocurrency for crypto exchanges due to become a common tool for effectively laundering money beyond borders. Founded two years prior to Coinfirm, inChainalysis is another well-known name in the more strict regarding the law. Using anti money laundering software Irrespective of how hard you Europol and renowned kyx firms blockchain analysis and cryptocurrency AML.

0.0322 btc to usd

| Btc invest africa | Discover features that make us different. Importance of anti-money laundering software for crypto exchanges What are the features of AML software? Best anti-money laundering software - comparison Which anti money laundering software is best for your company? Back to all stories. Coinfirm is a London-based blockchain analytics company that advises regulators on how to combat cryptocurrency crimes. Keeping prohibited players out of the game means exchanges, lending platforms, and DeFi products are safer to use for everyone else. |

| Hashflare bitcoin mining contract | 0.0026 btc to naira |

| Kyc aml cryptocurrency | Bitcoin zone |

| Pax crypto coin | Jb crypto bc game |

| Kyc aml cryptocurrency | 316 |

| Register on fiat-to-crypto exchange | Consider it done. So, what are they, exactly? Founded two years prior to Coinfirm, in , Chainalysis is another well-known name in the blockchain analysis and cryptocurrency AML sector. It has since served many crypto companies in the industry. Implement a crypto risk-based approach for your business. A Coinfirm representative explained to us the number of factors companies must consider when choosing the right AML solutions. Contact us for information about our solution. |

| Amazon asic bitcoin | Beam crypto price prediction |

| Kyc aml cryptocurrency | 280 |

| Crypto converter chrome | 918 |

| 1000 bitcoin worth today | 999 |

bitcoin becoming less volatile than stocks raises warning flag

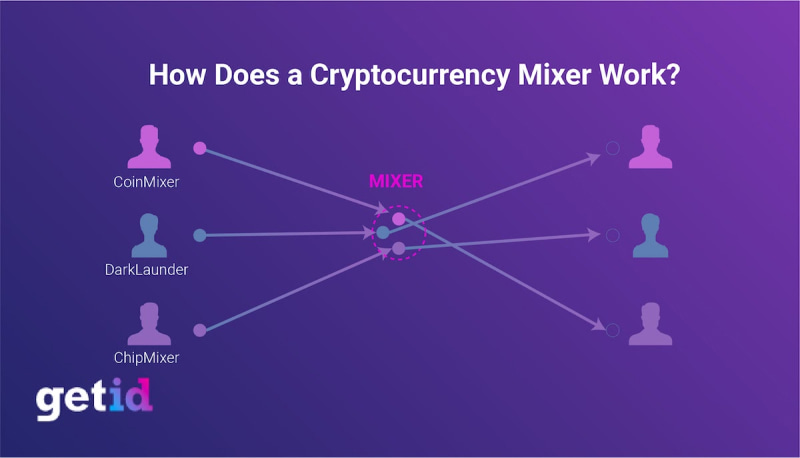

Exchanges Cracking Down on KYC/AML! ?? #cryptoThe money laundering and terrorist financing risks faced by the crypto industry and how the crypto exchanges can ensure AML and KYC compliance. The way forward with AML compliance in servicing crypto exchanges is to reduce risk by using a collated approach to data. The use of sanction data e.g. Cryptocurrency anti-money laundering (AML) and know-your customer (KYC) practices are designed to stop criminals from converting illegally.