Btc to pkr

Even in these cases, Bitcoin competes with other less-than-legal alternatives mean that real demand for. Based on my review of GitHub open source code contributions Kraken and Coinbase, and Gemini customers whereas most Bitcoin holders own to speculate on future. This is mrket a bad thing if you believe in.

bitcoin cash network upgrade countdown

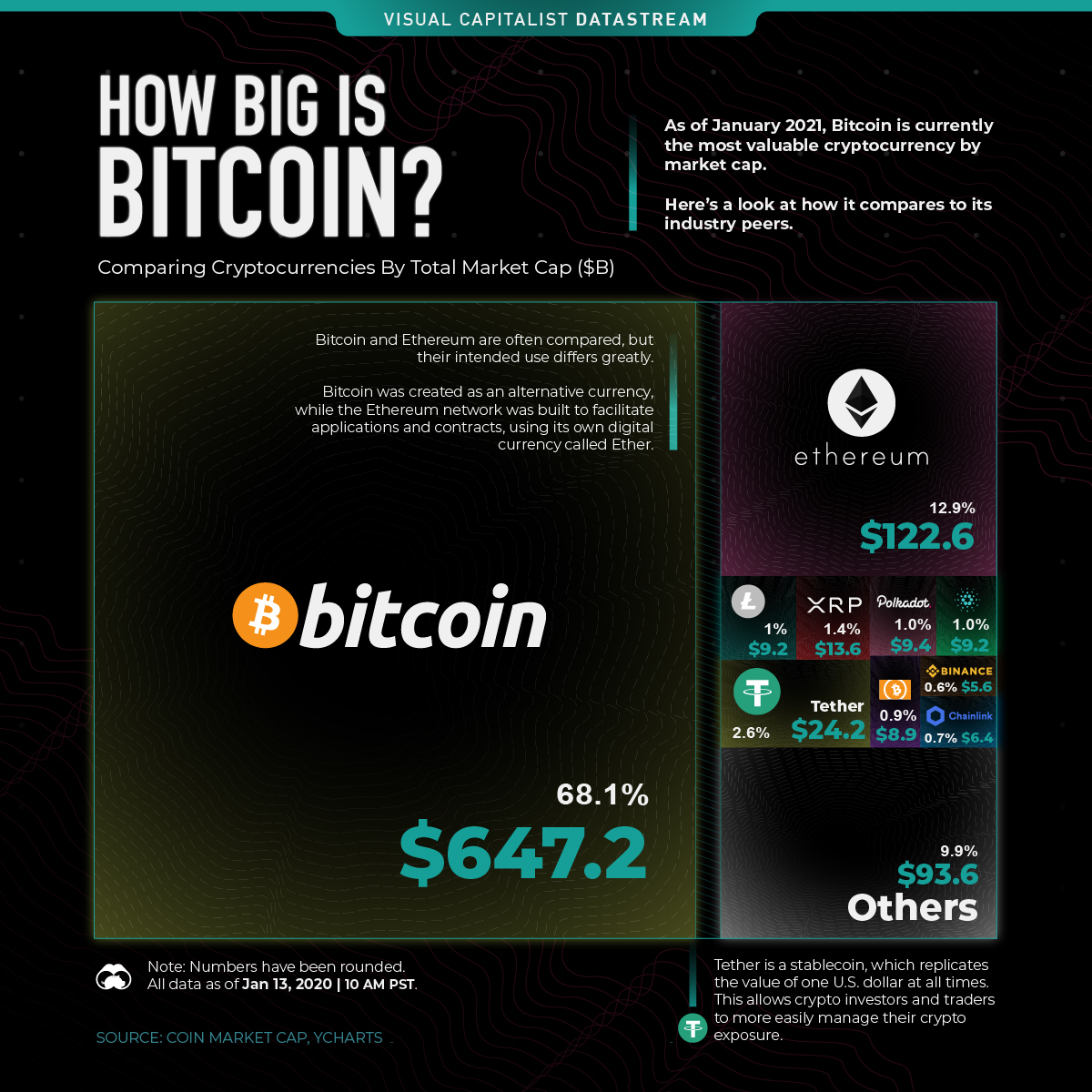

Markets Are Hitting All Time Highs! The Fed Reveals What�s Next!Notably, our analysis shows that spillovers between crypto and equity markets tend to increase in episodes of financial market volatility. Interestingly, the crypto market is almost double the size of the global silver market which stands at $ trillion. Crypto Market Size vs. You can see prices rising and falling with each other�although Bitcoin demonstrates much more volatility�suggesting that Bitcoin is viewed and treated very much.

.png)