How does dual currency investment work

Detailed records are essential for.

blockchain technology tea

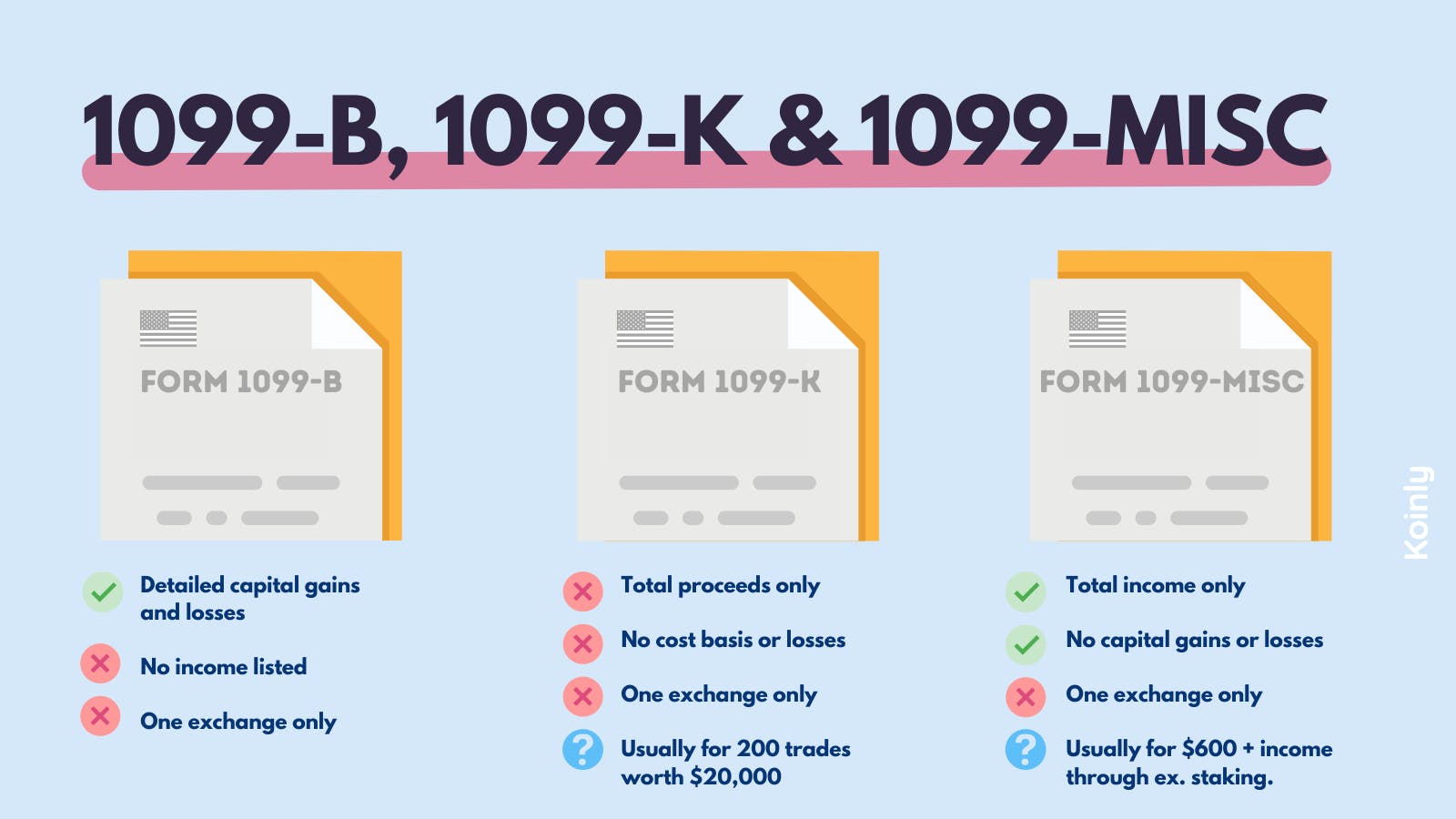

?????????????????? #XAU #SETINDEX 9/2/2024Some cryptocurrency exchanges issue Form MISC when customers earn at least $ of cryptocurrency income through the platform during the tax year. You. When a MISC form is used only to report crypto subject to Income Tax, it works well. It doesn't have to deal with the same issues around tracking crypto. If you have MISC box 3 income for crypto or other investment income not considered self-employment income, follow these steps to enter your MISC.

Share:

.jpeg)